The ROG Xbox Ally X is seeing its first major price adjustment since launch, with reports confirming that the handheld has become more expensive for consumers in Japan. This pricing shift for the collaborative device between Asus and Microsoft is not an isolated incident but rather the latest symptom of a broader economic trend currently straining the global gaming and technology manufacturing sectors.

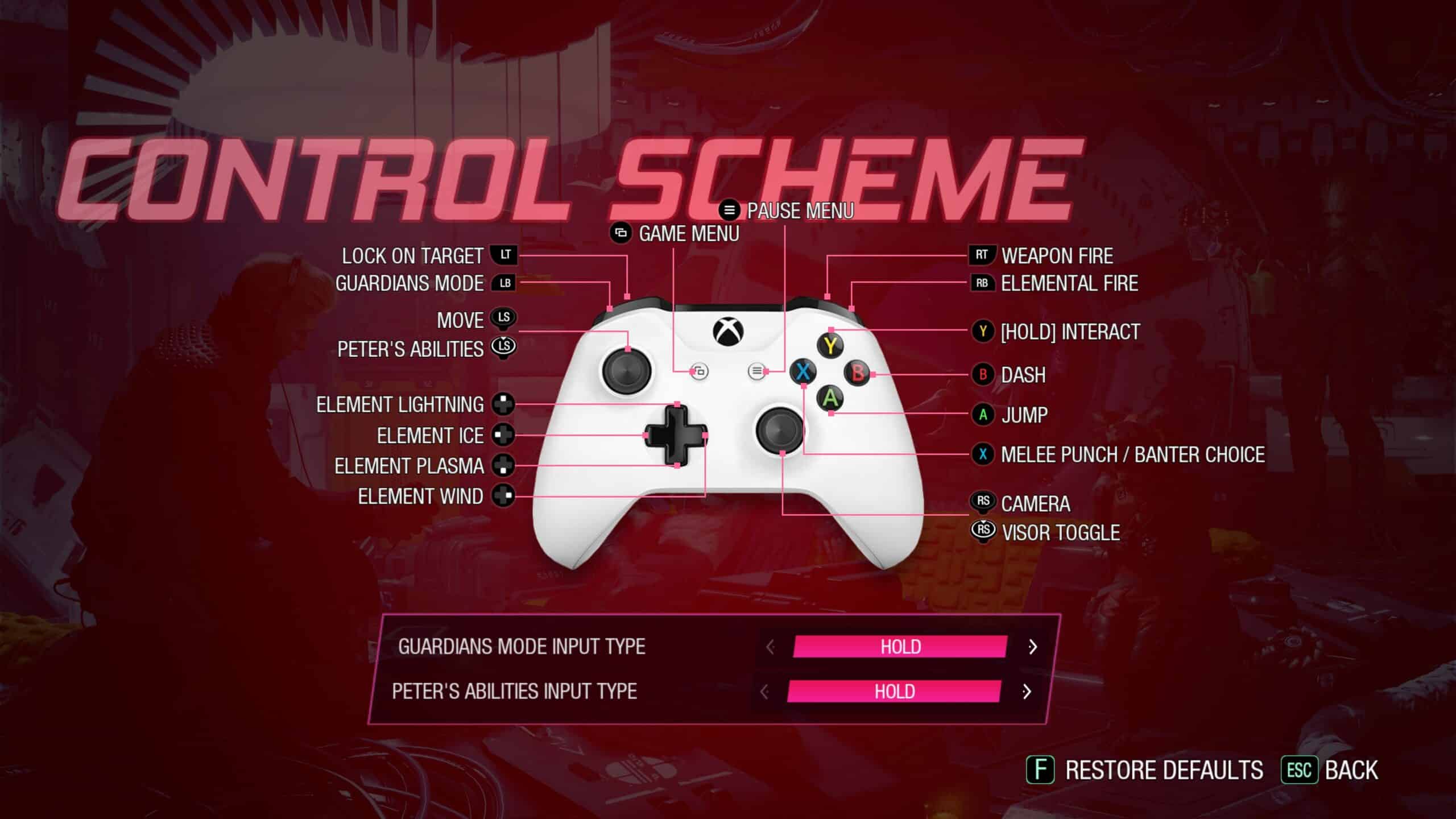

Initially arriving on the market in October 2025 following a series of production delays, the ROG Xbox Ally X was designed to bridge the gap between high-end PC gaming and the accessibility of the Xbox ecosystem. By utilizing Windows 11 as its core operating system, the device allows players to bring their existing libraries from Steam, Battle.net, and the Epic Games Store into a portable format. While the hardware has been praised for its performance and regular system updates, this price increase in a key territory like Japan suggests that the cost of maintaining such high-spec mobile hardware is becoming more difficult for manufacturers to subsidize.

Industry analysts point to the ongoing volatility in hardware components and shipping logistics as the primary drivers behind these adjustments. Japan, often a bellwether for electronics pricing due to its high concentration of tech enthusiasts and manufacturing hubs, is frequently the first region to reflect these shifts. For many gamers, this increase raises concerns that similar price hikes could eventually migrate to Western markets, particularly as the cost of specialized mobile processors and high-density battery technology remains high.

Despite the rising cost, the Xbox-branded gaming tablet remains a unique fixture in the handheld market, offering a level of integration with Game Pass and PC launchers that many competitors struggle to match. However, with the barrier to entry now higher in at least one major region, the pressure is on Asus and Microsoft to ensure that the ROG Xbox Ally lineup continues to receive the software optimizations and feature sets required to justify the premium investment. Whether this is a temporary regional adjustment or the beginning of a worldwide trend remains to be seen as we head further into the 2026 fiscal year.